Recent market turbulence has been a stark reminder of the risks that come with investing in high-growth stocks. The past few weeks have seen significant drawdowns across major technology names, reflecting broader uncertainty and increased volatility.

Consider the following declines from recent 52-week highs:

These sharp declines highlight the challenges of navigating a market environment driven by rising interest rates, shifting economic policies, and global uncertainties. While these assets may present long-term opportunities, their short-term swings can be nerve-wracking for investors seeking stability and reliable returns.

Recent Market Volatility in Perspective

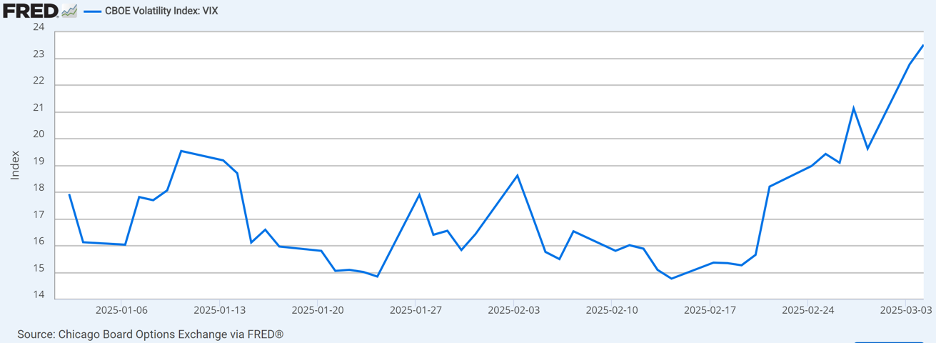

To further illustrate this, below is a chart of the CBOE Volatility Index (VIX) year to date, showing the market’s increased uncertainty. As the VIX spikes, signaling heightened investor anxiety, many are reassessing their exposure to high-volatility assets. Historically, the VIX average is about 17.

The Case for Less Volatile Investments

At Eppler Capital Funds, we focus on providing investors with opportunities that offer consistent, predictable income. Our promissory note fund delivers secure, fixed-rate returns of up to 9% per year—far from the rollercoaster ride that many growth stocks have been experiencing. Additionally, our music royalty investment offers a unique, uncorrelated asset class that provides steady cash flows regardless of market swings.

Diversification is key to weathering market uncertainty, and now may be a good time to consider allocating a portion of your portfolio toward stable, income-generating investments.

If you’d like to discuss how to balance your portfolio for both growth and security, please reach out.

–Craig

This Offering is only available to “accredited investors,” as defined by Rule 50l(a) of Regulation D of the Securities Act of 1933, as amended. This Offering is being conducted pursuant to Section 4(a)(2) and/or Rule 506(c) of Regulation D under the Securities Act of 1933, as amended, and pursuant to applicable state laws that provide an exemption for limited private offerings. This Offering is not generally available to the public nor may any offers be made in states or jurisdictions that do not recognize such an exemption.

Copyright 2025 Eppler Capital. All rights reserved.