07/17/2025: The Power of Monthly Income

How Long Could You Survive Without Income?

? Why This Matters

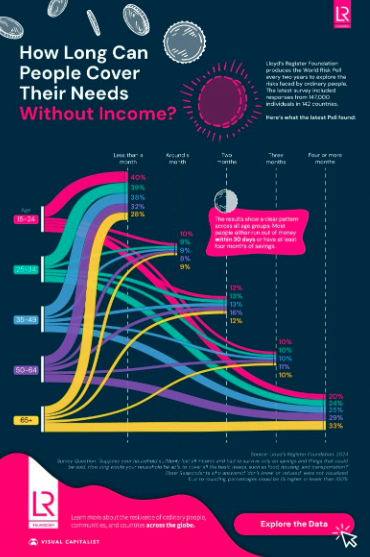

Visual Capitalist’s recent report reveals a sobering truth: nearly 4 in 10 people under 34 wouldn’t last more than a month without a paycheck.

That’s not just a budgeting issue, it’s a resilience issue.

Across all age groups, the data paints a stark divide:

- ~40% of people globally can survive ≤ 1 month without income.

- Only ~25–30% can survive ≥ 4 months.

We’re living in a two-tier system: those with cash flow and buffer, and those on the edge.

Monthly Income Is the First Layer of Resilience

Here’s why it matters:

Recurring bills don’t stop: Rent, groceries, childcare, they all hit monthly. So should your income.

You need time to think: Income buys time in a job loss, illness, or family crisis. Without it, decisions become desperate.

It’s your base layer: Savings, investing, and long-term planning only work when monthly income is reliable.

What Can You Do?

Whether you’re working a 9–5, running a business, or investing for passive income, the mission is the same:

- Audit your runway: How many months could you survive with no income?

- Build multiple income streams: Rental income, dividend-paying investments, side gigs, it all adds stability.

- Automate your cash flow: Budget monthly, pay yourself first, and structure investments that deliver consistent distributions.

Our Take

At Eppler Capital Funds, we believe monthly income isn’t just a goal, it’s the foundation. It gives you peace of mind, financial breathing room, and the flexibility to act, not react.

In a world where millions are one emergency away from crisis, income-focused investments are more relevant than ever.

Best,

Craig