06/20/2025: Why Holding Cash Might Be Costing You

It’s tempting to hold onto cash when markets feel unpredictable. Cash is flexible, familiar, and for many, it feels safe.

But here’s the truth:

Cash loses value every single year.

Inflation slowly erodes what your dollars can buy, and over time, the effects are staggering.

The Decline of the Dollar

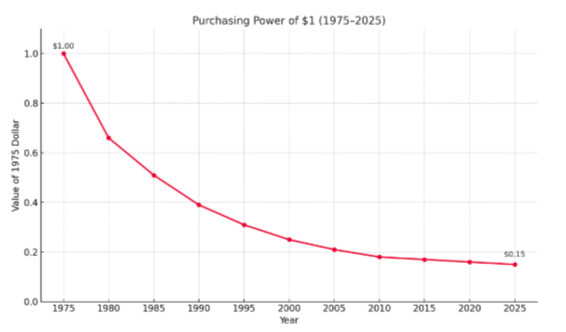

We often don’t notice inflation in real time. But if you step back and look at the last 50 years, the reality becomes hard to ignore:

Year What $1 Bought Then What It Takes Today

1965 A movie ticket $16.08

1980 One share of Disney stock $117

1984 1 dozen eggs $3.17

1989 1 gallon of gas $3.20

2010 Fast food hamburger $5.29

In purchasing power terms, $1 in 1975 is worth about $0.15 today. That’s an 85% loss over 50 years, just from the passage of time.

The Illusion of “Safety” in Cash

Let’s say you’re holding onto a large cash position today, earning 1–2% in a savings account. Meanwhile, inflation is running at 3–4%.

That means:

- You’re guaranteeing a negative real return every year

- Your purchasing power shrinks, even as your account balance stays the same

- Over a decade, this can silently erode 30–40% of your wealth

Cash has a role, for short-term needs and emergencies, but as a long-term wealth strategy?

It quietly loses to inflation. Every time.

What to Consider Instead

True financial stability often comes from:

- Diversification across asset types

- Earning consistent, real (inflation-beating) returns

- Avoiding the trap of “waiting” in cash

If you’ve been sitting on the sidelines, ask yourself:

What is my money really doing right now?

Because in 10 years, that $1 in your bank account may not look, or feel, like a dollar anymore.

Final Weeks to Lock In Our Current Terms

Eppler Capital Funds is raising the minimum investment for our Promissory Note Fund from $10,000 to $50,000, effective June 30, 2025.

If you’ve been considering getting started or increasing your investment, now is the time to act under the current structure:

- Fixed income returns up to 9% annually

- Monthly interest payments

- Simple, asset-backed investment with no stock market exposure

After June 30, new investors will only be eligible for the $50K minimum. All existing investors will be grandfathered in under their original terms.

Best,

Craig